Overcoming Banking Digital Transformation Challenges

6 Mins

Updated: January 7, 2026

Published: September 26, 2025

Successful digital transformations in banking and financial services can lead to improved business outcomes through enhanced operational efficiency, increased customer retention rates, and accelerated innovation. The benefits are promising, but digital transformations in banking aren’t without challenges, sometimes so complex that the digital transformation fails to succeed. This article examines the benefits of digital transformation in banking, the central challenges banks face across the industry, technology, and market, and how a structured change management approach, such as the Prosci Methodology, drives tangible results.

Understanding Digital Transformation in Banking

Digital transformation in the banking and financial services industry involves utilizing digital technologies to modernize the way financial institutions operate, meet customer expectations, and deliver value. Ultimately, banking digital transformations enable faster decision-making, improve customer experiences and create more resilient operational workflows.

More than digital technologies, digital transformations in banking also require financial institutions to rethink how people work together, how they make business decisions, and how their culture supports customers. The people side of change requires aligning leadership, employees and customers around new ways of working while keeping up with evolving regulations and changing expectations.

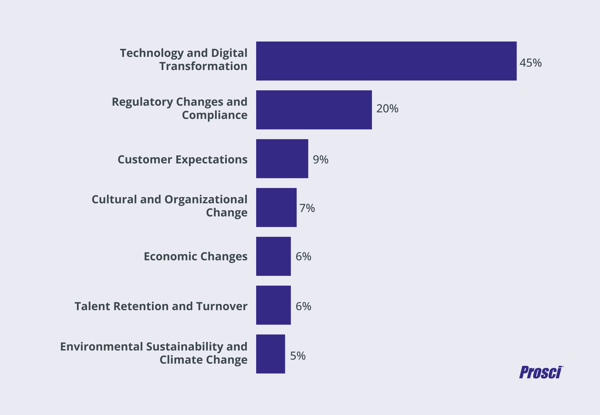

Digital transformation in financial services is a business imperative. In fact, our Best Practices in Change Management benchmarking survey of leaders in the banking industry highlights that technology and the need for digital transformation is the biggest challenge facing the industry over the next five years.

Top CM Challenges in Banking

Financial institutions that engage their people, strengthen their culture, and build strong change capabilities are better positioned to overcome challenges during digital transformations, resulting in a higher rate of success.

Digital Transformation Challenges Banks Face

Despite the promising advancements and advantages of digital transformation in banking, these large-scale initiatives introduce real challenges for financial institutions. Below are five common obstacles financial service providers face during their digital transformation journey, along with change management strategies for overcoming them.

1. Regulatory compliance challenges

Banks and other financial services providers operate under strict regulatory environments. They must accurately navigate various regulatory requirements. Some examples include the Gramm-Leach-Bliley Act (GLBA), the PCI Data Security Standard (PCI DSS), Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) policies and measures, and Payment Services Directive (PSD2). Additional local compliance mandates further complicate the regulatory environment.

While meeting regulatory requirements is non-negotiable, the pace of regulatory change often surpasses the pace of technological adoption, creating tension between compliance and innovative efforts. Compliance missteps can delay transformations, trigger audits, and damage trust with customers.

How change management helps

A structured change management approach, such as the Prosci Methodology, incorporates risk management strategies from the outset by involving compliance teams early in the process, facilitating better planning before new systems go live.

Prosci’s 3-Phase Process provides a structured yet flexible framework for driving change at the organizational level. In Phase 1 – Prepare Approach, teams work together to position the change for success, which involves assessing risk, including compliance risks. By engaging compliance officers early, aligning them with project teams, and establishing clear objectives and metrics, banks can anticipate regulatory requirements and integrate them into their transformation planning.

2. Legacy systems and technological complexities

One of the biggest inhibitors of digital transformation in banking is the presence of outdated core legacy systems. Aging systems may have multiple dependencies, high maintenance costs, and limited scalability and connectivity functionality. Replacing them requires a significant investment in both budget and human resources, and can increase the risk of operational disruptions.

Prosci’s Keys to Unlocking AI Adoption study reveals that 16% of AI adoption challenges stem from system integration issues. Without careful planning, even routine tasks can be affected during implementation.

How change management helps

Legacy modernization causes a shift in people's day-to-day work. Implementing new technologies requires changing behaviors, and employees accustomed to old systems may resist the change or struggle to adopt the latest technology.

The Prosci ADKAR® Model — Awareness, Desire, Knowledge, Ability, Reinforcement — equips leaders to engage individuals effectively during the change process and prevent and manage resistance. The ADKAR Model offers strategies and tools to guide individuals through ADKAR transitions, facilitating successful organizational change.

Prosci ADKAR Model

3. Customer expectations and demands

As technology advances, banking customers have higher expectations and seek varying experiences. Some want personalized, seamless, and always-available digital access, including mobile banking, real-time payments, as well as readily accessible financial advice. While some customers prefer a digital-first experience, banks must also support accessibility for clients who prefer traditional channels, including in-person banking.

Additionally, launching new digital tools, such as mobile apps and digital wallets, can enhance the customer experience. Improving and modernizing core banking services to include these features helps meet customer demand, remain agile, and stay competitive. But if the launch experience is unclear or too challenging to navigate, these enhancements can leave a negative impression on customers. Maintaining customer satisfaction is necessary for success.

How change management helps

Meeting diverse customer needs while balancing the introduction of new technologies requires effective sponsorship and strong cross-functional alignment. Using a structured change management approach helps ensure that banks structure and fill the core roles needed to drive change successfully while keeping the customer journey at the forefront of strategic planning.

4. Data security and privacy concerns

Cybersecurity is of utmost importance in digital banking as banks remain a desirable target for fraudulent activity, data breaches and ransomware attacks. Of equal importance, regulations mandate strict data protection, and customers want to know how banks use their information and who has access to their sensitive data. Balancing innovation with robust security protocols for protecting customer data is a challenge for today’s banks.

How change management helps

An effective change management strategy enables banks to clearly communicate security measures and involve risk and cybersecurity teams at the earliest stages of the change process. It helps ensure that staff understand security measures, know how to implement them, and consistently reinforce secure behaviors. Additionally, Prosci’s ADKAR Model helps ensure that employees receive the necessary training to understand their role in protecting data while advancing their digital transformation goals.

5. Cultural resistance and organizational pushback

Resistance is a natural human reaction to change that arises when individuals face uncertainty, perceive threats, or are not aware of the reasons behind the change. Digital transformations in banking are not immune to resistance. Employees may fear replacement by automation, distrust leadership’s vision, or experience change saturation if there are too many simultaneous transformation efforts. Without addressing cultural barriers, even the best-laid digital strategies can stall or fail.

How change management helps

Prosci research shows that preventing resistance to change is more effective than addressing it reactively. With the right change management strategy, banks can establish a clear vision for transformation and involve employees early to minimize resistance and build momentum. The success of any change initiative is closely tied to how well financial organizations manage resistance through effective change management approaches.

Technological Challenges in the Financial Sector

While regulatory pressures, legacy systems, and cultural barriers create obstacles, the technology itself introduces its own set of challenges. For banks and financial institutions, the pace of innovation often collides with the complexity of technology. Below are three of the most pressing technological challenges banks face, along with an explanation of how change management can help address them.

1. Integration of new technologies

To remain competitive, banks frequently adopt new digital solutions, including mobile apps, payment platforms, customer engagement tools and cloud services. However, integrating new technologies with core legacy systems and other long-standing technologies is rarely straightforward. Complex data architectures, fragmented data sources, and reliance on third-party vendors can create significant roadblocks and downtime.

How change management helps

Focusing too much on the technical aspects of change can lead to technology deployments failing to meet expectations. For successful change, financial institutions must also focus on the people, as organizational change requires individuals to transition from their current state to the future state. The Prosci Methodology enables organizations to manage the people side of change.

2. Big data and analytics

The financial sector generates massive volumes of data daily, offering opportunities for personalization, fraud detection, and more intelligent decision-making. However, siloed datasets, a lack of advanced analytics capabilities, and workforce skill gaps prevent banks and financial services providers from fully maximizing the benefits of big data.

How change management helps

Successfully leveraging big data requires both cultural and technical transformation. Teams need to trust the data, adopt new tools, and develop data literacy. Prosci’s ADKAR Model helps institutions build awareness of the value of analytics, create a desire to use insights in decision-making, and reinforce behaviors that prioritize data-driven strategies.

3. Artificial intelligence (AI) and automation

AI and automation promise efficiency gains in areas such as customer service via chatbots, credit scoring, fraud detection, and back-office banking operations. Yet implementation is far from simple. These initiatives raise ethical concerns, questions about integration with existing processes, and employee fears of job displacement. Without a careful and intentional rollout, AI projects risk resistance from both employees and customers.

How change management helps

Introducing and incorporating AI fundamentally changes the way bank employees work and how customers access financial information and services. A structured change management approach ensures employees understand why AI changes are necessary and their benefits, and are trained to work alongside new tools while understanding the value they bring to their work. By engaging stakeholders early, banks can address fears, align leadership messaging, and establish trust in AI-driven processes. This increases adoption rates while reducing the risk of poor return on investment (ROI).

Market Competition Challenges in Financial Services

Traditional financial institutions are no longer competing only with each other; they are under pressure from fintech startups, big tech firms entering the financial services sector, and even non-traditional players, such as digital wallets and peer-to-peer lending platforms.

Unlike fintech firms that build systems from scratch, established institutions must contend with the challenges above, including legacy infrastructure, complex regulatory environments, and diverse customer bases. Consumers are often willing to switch providers if a competitor offers faster, cheaper, or more convenient services.

To maintain a competitive advantage, banks must think beyond digitizing existing processes and must redefine how they deliver value to customers. Some key strategies include:

- Leveraging trust and reputation: Unlike fintechs, banks have a long-standing credibility in managing risk and compliance, which serves as a differentiating advantage.

- Investing in customer experience: Streamlined onboarding, personalized financial advice, and omnichannel engagement can elevate the customer experience.

- Forming partnerships: Collaborating with fintechs through open banking initiatives or joint ventures allows banks to innovate without starting from scratch.

How change management helps

Differentiating in a crowded, fast-moving market requires bold business transformation and organizational alignment. Prosci’s ADKAR Model helps employees understand why differentiation matters, build the desire and skills to deliver it, and reinforce new behaviors. With structured change management, banks can turn competitive pressure into a catalyst for innovation and growth.

Managing the People Side of Change in Digital Transformation in Banking

Digital transformation is redefining the world of banking and financial services. While new technologies bring potential, banks face a unique set of challenges across industry-specific, technological, and market factors. Real change can only happen when employees are engaged, equipped and supported throughout the digital transformation journey.

Change management provides the structure and tools to embed structured change capabilities and support transformation at every level. With a people-first approach, you can act more quickly, build resilience, and create a lasting impact. That’s the power of change done right.